Results 181 to 190 of 201

Thread: Tax the Rich

-

12-08-2012, 12:50 AM #181

OK

Tell how a rich person avoids sales tax?

A rich person can easily avoid sales tax by taking a nice vacation sans suitcase. They leave with their worst cloths on, and come back refreshed with a whole new wardrobe including jewelry! Happens all the time! Heck I have done it!

But that's not the point. The poor have to buy what they buy on a monthly basis or on a paycheck to paycheck basis. Hence they pay sales tax on things usually at full price. A rich guy can wait for sales and stock up hence paying less. Think about it for a while.

Show me a rich person paying 10%.

I don't know what you are asking here? If they are making 100K and being taxed 10K then that's 10%... ok - I see - read my next answer.

Show me a person making 20K paying 10K in taxes.

Crotalus - I don't know why you have it in for me, but it was Glen who said tax everyone 10K - so using his example and responding to his idea to a solution - a dude making 20K would get taxed 50% - read the whole thread man!

Everything you said is over the top.

Yes I can see how a man who can't read and just skims things to go onto the offensive might think so! I tell you what - you take the time to read and think - and I'll take the time to be more pleasant!!David

-

12-08-2012, 12:54 AM #182

Well that's a false dichotomy.

The question is how regressive should the tax code be. Now, if you want to take a fair amount of ideological dogma you can ask people what is the type of society they would like to live in, i.e how much inequality is desirable. Incidentally that's already been asked and the results are that people would like to live in a scandinavian type society, which have a lot more income redistribution than USA.

Alternatively you can also look at the historical regressiveness of the tax code in USA and then take a look at the resulting societies.

Of course, you may happen to be an ideologue and then the logical position is that everybody ought to pay for their own stuff. The government should probably only deal with the law enforcement and judiciary (defense certainly should be privatized and the free market can take care of that funding). I think then everybody should pay flat amount for the judiciary, but I'm not quite sure about the law enforcement, because the guy who only has 1K to his name probably doesn't care as much about the protection of his property and life as much as the guy who has 1B.Last edited by gugi; 12-08-2012 at 12:58 AM.

-

12-08-2012, 12:55 AM #183Senior Member

- Join Date

- May 2006

- Posts

- 2,516

Thanked: 369

-

12-08-2012, 12:58 AM #184

-

12-08-2012, 01:00 AM #185< Banned User >

- Join Date

- May 2012

- Location

- Forest Park

- Posts

- 282

Thanked: 44

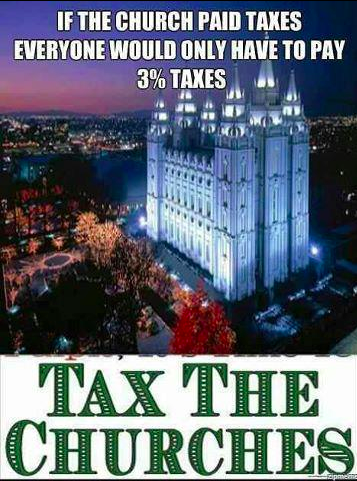

The solution?

-

The Following User Says Thank You to sheffieldlover For This Useful Post:

earcutter (12-08-2012)

-

12-08-2012, 01:04 AM #186Senior Member

- Join Date

- Mar 2012

- Location

- Thunder Bay, Ontario, Canada

- Posts

- 17,334

Thanked: 3228

I don't think that was the point at all. The poor by circumstance cannot be patient, creative or smart even if they wanted to be. OTH the rich can by their very circumstance of being rich. It is like freedom, everyone is entitled to it equally only the rich can afford more of it.

BobLife is a terminal illness in the end

-

12-08-2012, 01:11 AM #187

It's bigger than that - you can make abortion illegal - the rich just hop on a plane to a place where it isn't. The poor either take their chances with shady back ally doctors or bear the burden of an unwanted pregnancy.

As for not paying sales tax - Heck - if you can buy enough to get free shipping, on Amazon you don't pay tax... It's easy if you have some savings!Last edited by earcutter; 12-08-2012 at 01:14 AM.

David

-

12-08-2012, 01:54 AM #188Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

WRT to the comment earlier that the government tried taxing the poor already. They did? When? Not in my lifetime. Instead, the rates applied to the poor have gone down and the interest loopholes the rich used in the past (like deducting life insurance interest, etc) are gone.

I don't mind if tax rates are increased some, as long as there is a corresponding exchange in spending cuts TODAY. All of the proposals so far have been current tax hikes in exchange for spending cuts in the future with no realistic entitlement moderation - no ability to control costs.

It's a lot like the health care bill where savings were assumed by reduction in physician reimbursement - none of it has happened yet. Instead, more money has been spent but no savings realized. Each year, the physician reimbursement rate cut is stayed and the debt gets bigger.

I want to see the spending cuts NOW if there are going to be tax cuts now, too. It's nothing more than a sham transfer of wealth to buy votes at this point, there is no restraint. It's political vote buying with someone else's money and no REAL discussion to a middle class that has consumed more than they have earned for the last 30 years.

-

12-08-2012, 02:00 AM #189Senior Member

- Join Date

- May 2006

- Posts

- 2,516

Thanked: 369

-

12-08-2012, 02:09 AM #190

Yes, but I don't like cop-outs, so what level of regression in the taxation should US have? The one from the Clinton years, the Reagan years, the Bush Sr, Bush Jr, or go further back. Since we're not reinventing the wheel, but merely picking one of the already rolled ones, there are only about two hundred choices.

226Likes

226Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote