Results 171 to 179 of 179

-

04-22-2015, 01:01 AM #171At this point in time...

- Join Date

- Jun 2007

- Location

- North Idaho Redoubt

- Posts

- 27,195

- Blog Entries

- 1

Thanked: 13250

-

04-22-2015, 01:24 AM #172

-

04-22-2015, 02:22 AM #173Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

I'm a registered independent. I'm not divisive at all, I think all politicians are morons and so is anyone who says "my team is X, i'll go with them on whatever they decide". I also think you're either being overselective where possible to create some kind of flaw in my argument, but it's weak.

https://www.treasurydirect.gov/govt/...ebt_histo5.htm

The debt has grown by more than 500 billion per year the last 10 years, and in years where the GDP grows significantly, or slightly trailing that (it takes time to collect the taxes), we should see a flattening, but still the debt is growing faster than GDP every single year.

You claimed that the debt was like operating business on debt, not me. Stick to your arguments, don't try to get out of them.

As far as plateaus, you need to average the effect, perhaps over a 10 year period (though some of the seeds of the 2008 crash were due to the relaxation of lending standards in the name of equality way back in the 1990s). You need to average the effect because trailing years give the illusion that the deficit grows more slowly soley due to market appreciation and realization of capital gains taxes, as well as some increase in income tax due to employment ( a lagging indicator ).

All of that said, the last 10 years have been complete failure to control costs, and these are on a current entry basis. Medicare already runs a deficit, and it's set to run away, and the only answer the current administration has is to claim that they will cut physician reimbursements and demand a drug discount. Those two things won't actually work, because the spending is immediate but the physician reimbursement cuts get kicked down the road every year. It's part of the legislative flaw here that bills are "pay as you go", they always include spending immediately and deferred savings that never materialize.

These things contribute to the debt. What do you think the legislative fix will be? I'll bet it will be more bills that rely on future savings and spend more now. The SS disability system here is completely out of control, it's seen as a place to run when you're over 50 (or under if you know the law well enough) so that you can't be laid off from a job or so that you don't have to retrain.

How we can have supposed expansion and a post-2008 period of market returns like we've had, and still not have a budget surplus, I have no clue. When clinton was in office and the lending standards were eased, we had all kinds of fake wealth that was really just spending borrowed money, and the market appreciation that came with it again created an illusion of some kind of budget wizardry. It was temporary taxes on paper appreciation caused by borrowing. In the end, it added to the debt and the idea there was a surplus was a farce, but the issues at the time and the real effect was childs play compared to current fiscal policy.

To pretend that the issue is minor or easily managed is a very bad joke when there is no realistic plan to cut spending and no realistic plan to raise taxes, but instead the plan every year takes more and more people (as a percentage) out of the group of tax payers and puts them into the group of people who pay no income taxes (and don't have any real assets to pay cap gains taxes). It buys a few more votes every year, but as far as an economic plan, we have none. I sure hope the oil price goes back up, because we really don't have anything going on here other than energy - and I mean dino energy.

We have a moronic administration that thinks you can throw money at "battery and solar" to be made here in the US in a society where we buy whatever is the lowest price. They don't even have a minimum amount of sense to ask "why would I make that here for $1000 when it can be made in china for $500..how many consumers will buy the $1000 version?".

It's what you get when you have an enormous group of attorneys (as lawmakers and executive branch) who have never run a business or held a real job, and their only job is to be narcissists and marvel at themselves, changing the rules of the games as they go along so they can declare themselves winners and shake down anyone who disagrees with them.

I really don't care which side brings some sort of fiscal responsibility to the table, I just want to see it from someone somewhere. Some modicum of realistic discussion.

-

04-22-2015, 02:29 AM #174Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

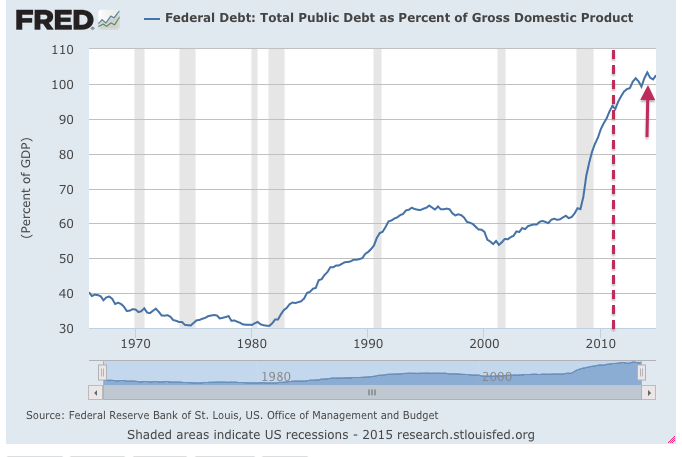

Here is a link from the st louis fed. In the real estate run up that was going on during the early part of the last 12 years, the increase as a % of GDP was still occurring steadily before the spike. It's an upward trend, not a plateau.

https://research.stlouisfed.org/fred...es/GFDEGDQ188S

Since 2008, it's just been completely out of control, which is the only reason that you might get the sense that somehow a 1% increase per year in debt as a percent of GDP is no big deal. That's in current dollars $180 billion a year when the GDP increases at only part of that. In a supposed time of expansion and high tax revenue.

-

04-22-2015, 08:19 AM #175

As I said I added a link to where I got the graph and you can see there what is included in the 'public debt' and what isn't.

You can add averaging and blur some of the dynamics, but even with 10 year average you'll see the change in 2008.

If I understand correctly you are saying this is still ongoing and the plateau at the end is fiction, once the data is in we'll see that it is still increasing steeply. You may be right, and only time will tell (3 more years should be enough cushion to know if the 2012-2013 is really flattening). However the data as it is matches pretty well with the recovery from the housing bubble burst which is pretty much the dominant effect on the economy in that timeframe. That is why I think the data is real and the situation is more of a paying a giant one time bill rather than spiraling into a black hole.

I haven't argued that there isn't a problem, I disagree on the nature of the problem and that it needs to be solved ASAP. It doesn't need to be solved ASAP and that is why it isn't being solved and is unlikely to be solved anytime soon.

A couple of years ago many people were pointing to the big slope before the dashed line and were saying the sky is falling need to fix the debt immediately. Some were claiming that such alarmist point of view is based on superficial analysis without understanding of the causes and consequences and basically predicted what the current graph is showing.

Regardless of that the plateau at the arrow means that the current political climate is different and the superficial analysis crowd can not make anymore a credible argument that things are completely lost. There is not much political pressure anymore and that's why you won't hear much about it.

In simple terms we're still in the hole, we're not digging, or at least not as frantically anymore, so we're not going to fall of the bottom of the world. Climbing out of it is still on the TODO list, but that's been on it for a long long time.

Japan has been running as a first world country and the second largest economy for decades with increasing debt. Perhaps a superpower can do the same and the US politicians have plenty of road ahead to kick the can forward.

I think that's been a political choice rather than a failure. The reasoning has been argumented plenty of times, basically get the economy running and get out of the recession instead of going into a depression. We even had a government shutdown and sequestration over it.

Apple is one of the largest US companies, more profitable than the others at that size and they manufacture almost everything abroad. The big money and high profit margins tend to be not in manufacturing but in technological innovations.

But US isn't a dictatorship, those people are elected and reelected in free and fair elections. If people vote differently and reward and punish different things than they do currently the politicians will behave differently.

Sure, it's not a solution, but it is the fundamental problem. May be it's unsolvable, may be it takes time and another generation or few.

-

04-22-2015, 04:36 PM #176

Folks tend to make so much of running a business as some prerequisite to running government. Government is nothing like business and some of our worst Presidents came from the business world.

You may think our lawmakers sit there and write the laws being proposed however most laws are written by lobbyists and presented to congressional staffers who quickly look it over. The individual congress persons don't have a clue what they are really voting on most of the time.

I found it amusing how a while back the Conservatives argued how the Government should be run like a family budget where you only get what you can afford and that's it. I guess these guys don't have mortgages or car loans or any credit card debt like most American's do.No matter how many men you kill you can't kill your successor-Emperor Nero

-

04-22-2015, 04:39 PM #177Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

There's really no reason to make the financials a partisan issue.

And, there's nothing in a household that compares to the burden that social security, medicare, SSDI, and obamacare will have on taxpayers. It's not similar to a household budget, and at the same time, there is nothing similar between a private individual getting a mortgage and the government taking on debt that they don't have any fiscal plan to repay.

As far as presidents go, the current president and the last president were the worst since carter. As much, though, as people like to put the mortgage collapse on the last president, the seeds of it were sown in the 1990s, those are the same seeds that made it seem like we were experiencing economic expansion as spending shifted drastically from infrastructure and business to personal debt accumulation via purchasing and remodeling properties - with dud loans.

I wonder what we'll do if and when interest rates rise. If they don't, that's a sign that the economy has no clue what to do with capital, and if they do, we'll be spending a thousand or a couple of thousand dollars per head of tax revenue (not per taxpayer, but per head) servicing past debt. All that the same time that we'll punt on revenue generating provisions in obamacare, as well as the cost saving provisions that are already there - it will be politically expedient to waive those at the time. And that's what will happen. I'd say it's human nature for that to be the course taken, but it's politician nature.

And if you think it's not, point to the year where we actually stuck with medicare physician reimbursement cuts.

re: the debt and why we'd need to have a large national debt, someone will have to tell me exactly how and why our economic situation is better than Germany.Last edited by DaveW; 04-22-2015 at 04:44 PM.

-

04-22-2015, 10:54 PM #178

When the household is at collapse and the car is being repossessed and the home in foreclosure to that family the world is coming to an end. It's a matter of scale.

As far as the seeds of economic collapse go the question is who was minding the store and allowed it to happen. There is an argument for Government Regulation. Without it these things happen again and again.No matter how many men you kill you can't kill your successor-Emperor Nero

-

04-23-2015, 04:53 AM #179

The president is nothing more than a figurehead the best we can hope for is they make a good choice in their advisers....

One of the troubles is that their advisers are the ones that get them elected.

Any fiscal plan whether it is family or government can and probably will include debt. There should be a reasonable expectation of the ability to repay it though...

In government and business I have seen many irresponsible choices made because of the thought I will pass it on the the next administration/generation and I won't be around to be held accountable.

At a family level if you or your son dies of starvation it is a big deal. From the governments point of view if it is 10,000 people that is minor.

139Likes

139Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote