Results 151 to 160 of 179

-

04-21-2015, 06:32 PM #151Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

I think you're being far too literal here in your interpretation of what "civil war" means. Nobody in this country has the stomach for real war, anyway, we're all armed and media connected now - nobody really has an upper hand.

Rioting would be about the extent of it, rioting and protests, like most places.

Economic collapse is the only thing that will really spur future change, and we're headed for it. Not in like a no-lights-are-on doomsday scenario, but in an austerity sense. Right now, we have lost track of how fast we're racking up debt because the currency is strong - not because it's strong here for a good reason, but because of the issues with the yen and the euro.

-

04-21-2015, 06:46 PM #152

The debt was the biggest problem only a couple of years back. Then everybody moved on just like Ebola was forgotten as soon as the election was over and it was no longer needed to whip people into outrage.

If you look at the economic parameters there is nothing to indicate a collapse anytime soon. The strong dollar slows down growth a little bit but that's it. The only slightly worrisome thing is that the distribution of the generated wealth is extremely heavily slanted towards a tiny fraction of people, and most people's incomes haven't increased for decades, but americans seem to be fairly comfortable with that.

Of course, with rising China and the appetite for more wars in US somewhere down the road US will lose its economic dominance and will have to deal with the world like every other country, not as a superpower. But that's a gradual process.

-

04-21-2015, 07:06 PM #153Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

Income distribution is something that's more of an idealistic issue.

The current and future debt is a much bigger problem, because our economy is like a failing business - there really is no plan going forward, other than importing a bunch of currently illegal immigrants to lower labor cost (which would only exacerbate both the number of people not working, and the rate labor is paid to actually do work).

The real issue is that there is no mechanism to decrease the deficit, and we have never seen any real commitment from any politicians on any side to do anything other than continue to grow the deficit. It's somewhere around 1x GDP here, it's increased significantly in the last dozen years (12 years ago it was 1/2 of GDP), and there is no slow down in ideas to send other peoples' money to someone else for political gain.

We also have a more complicated state and local setup than most, and we have significant debt at those levels that is not recorded or not yet realized (future benefit costs, etc).

You might not think it's that bad, but closer analysis to the issues suggest that it needs to be addressed ASAP.

There are places in the world where it's worse, but that doesn't mean it's good here (the financial situation).

The biggest problem is that you can buy votes with someone else's money, but you can only lose your own votes by suggesting that you shift less money from person A to person B.

We've also got a horrible corporate tax structure that makes it uninviting for business, but no hope of doing anything about it because we're not in any position to give up any revenue.

Couple that with our regulatory structure and the ease of getting benefits (why work for $15 an hour when you can get the equivalent and work under the table) and there's no real hope for any change, but things can continue to get worse fast.

Here's a glimpse at the increase in debt in the last 6 years - it's gone from 10 trillion to 17.8 trillion. That's an increase of 7.8 billion dollars. we have about 135 million taxpayers in the US, but only about half of those actually pay federal income tax. So the 7.8 trillion falls on corporate and indirect taxes and 67.5 million people paying taxes.

Now, the corporate and indirect taxes eventually are paid by the folks who have their income redistributed in the first place, so the burden falls on roughly 68 million filers. That burden is an increase of $114,705 per filing taxpayer in the US over that period. Where is it going to come from? If you want to inflation adjust the base year, you could say that about 17% of the change is inflation adjustment, so that would put the real increase in today's dollars for new debt at $95,205. In order to service that debt over 30 years at 4%, the average person paying federal income tax would have to come up with about $450 a month for the next 30 years. Do you think anyone has that to come up with? I don't. Half of the population (including some high earners) can't rub two nickels together here, but they sure are willing to vote for someone who will allow them to suspend financial disbelief.

Currency collapse isn't coming tomorrow, but from a practical standpoint, defaulting on debts isn't far away.

And this increase in debt has occurred with historically low debt service rates. When they go back up, it's just that much less money that we have or that much more added to the deficit. Debt service rate increases mean another $180 billion per 1% increase in debt service rates.

That would be assuming that there is any economic activity where someone can actually do something with borrowed money - most businesses here seem to have no use for borrowed money, they have no business plan that makes it worth taking a risk.

-

The Following User Says Thank You to DaveW For This Useful Post:

jmercer (04-21-2015)

-

04-21-2015, 07:38 PM #154

There is a straightforward mechanism - increase taxes/cut spending.

If you like to think of US as a business the debt is not a problem at all because you have somebody else's money that you are successfully operating with. Plenty of businesses do that, remember how in 2008 the Fed had to intervene because commercial paper is that important.

Not to mention that running a business with one's own capital only is generally not done unless you're very small or very big. Easy access to capital is one of the major advantages of US as a place for running business.

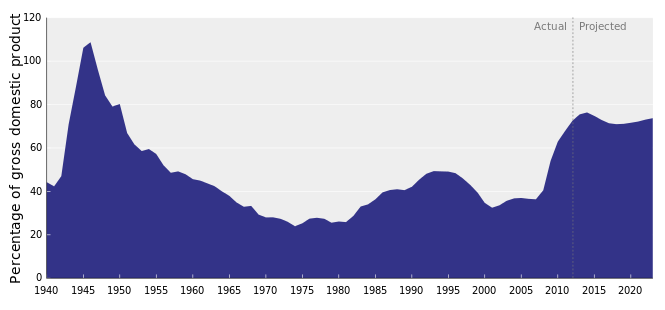

Here's the public debt/GDP ratio from Wikipedia - it is nothing like what you're saying.

There is a dotted line at 2012 after which it's projected, because the data is not completely analyzed but the current figure is 74% (GDP calculated from Q4 2014 and debt figure from, March 6 2015)Last edited by gugi; 04-21-2015 at 08:13 PM. Reason: add link

-

04-21-2015, 07:46 PM #155Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

Your picture is exactly like what I said, except it somehow assumes that the debt is <40% <80% slightly for the endpoints (2012 and 2014). For some reason, the denominator in your chart is different than the data I saw, I have no idea. It scales the chart, but doesn't change the relative differences.

I have no clue why they think that 2015 won't add anything, because the projected deficit provided by the CBO this year (without any major wars, etc) is $500 billion. Your chart shows it flat in 2015, which would only be the case if 500 billion is less than the increase in GDP (it is not).

Your assessment about running a business on debt is not accurate, because the government doesn't produce anything, and unless the past debt is for infrastructure (which it is not) we have no reason to believe that it will be correlated with increased future growth. Instead, in this case, we can only view it as initial installments in future obligations. It works the other way around.

And that doesn't include medicare or social security current or projected future deficits.

I certainly agree on tax more or spend less, the problem is pretty simple. I just have zero faith that any of the elected officials have the stomach to do those in the correct combination, and they can't really at this point without creating a recession. There is no economic momentum.

The only part of your chart that includes numbers similar to now is post wwII, and this is hardly a situation like that, nor do we have the economic standing to generate activity like we did in the 1950s and 1960s. There was no china and no japan back then economically, and there were all kinds of things we could do here better than elsewhere. At this point, I can't think of many things where that's true - generally every innovative idea involves the idea itself and then production overseas.

-

04-21-2015, 07:49 PM #156Senior Member

- Join Date

- Jul 2011

- Posts

- 2,110

Thanked: 459

A better illustration of the problem:

U.S. Fed Govt Debt Per Resident Over Time - Supporting Evidence

At any rate, US GDP at the end of 2014 was approximately 17.7 trillion, and debt was 17.8 trillion, so your chart is not correct. maybe you can tell me what the numerical background in it is, because every other chart I've seen has us around 100% of gdp or a little above.

-

04-21-2015, 07:54 PM #157Senior Member

- Join Date

- Dec 2013

- Location

- Virginia

- Posts

- 1,516

Thanked: 237

I'm just a realist, and I see what's coming. The two sides are so different we will never agree on anything. The left can have half the country, impose their will on the people, take away all guns, rights, liberties, and freedom. They can let everyone have everything they want without working. Then the right can have their half, promoting freedom, limited government, those who work hard succeed. No one gets handouts and they aren't forced to live their lives based on how the government sees fit. We'll see which one collapses first..

Last edited by prodigy; 04-21-2015 at 07:58 PM.

-

04-21-2015, 07:56 PM #158Senior Member

- Join Date

- Dec 2013

- Location

- Virginia

- Posts

- 1,516

Thanked: 237

-

04-21-2015, 08:07 PM #159

Until we can get past our dysfunctional political parties and elected officials not much is going to change for the better. The us vs. them mentalities are dividing us (just look at this thread). What happened to give & take and working together to come to consensus.

Shave the Lather...

-

04-21-2015, 08:29 PM #160

Never mind hey boys. Your conversation about economics seems to be exact the same that is going on in every country i know. Except for public health care that seems to have major consensus everywhere else. It's working for the rich and for the poor.

Well, everywhere else they do not mess with private insurance companies. Those companies are volunteer choice for everyone who so decides but with not much improvement.'That is what i do. I drink and i know things'

-Tyrion Lannister.

139Likes

139Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote